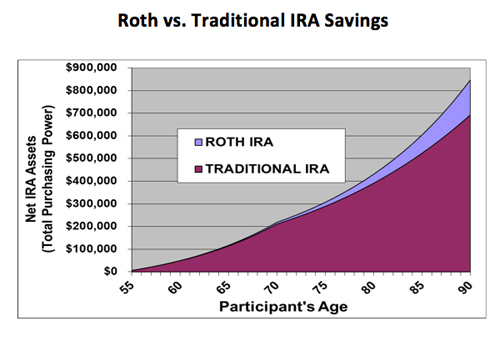

The Roth IRA remains one of the most powerful vehicles for long-term, tax-free wealth compounding—especially for high-income earners and younger investors. Unlike traditional IRAs, Roth contributions are made with after-tax dollars, but all future growth and withdrawals (after age 59½ and a five-year holding period) are entirely tax-free. This unique structure makes asset selection critical: the best investments for a Roth IRA are those with the highest long-term return potential, not income generation or short-term stability.

Why Growth-Oriented Assets Belong in a Roth IRA

Because Roth IRAs are shielded from capital gains and dividend taxes, they are ideal for holding assets that historically deliver strong appreciation—particularly those that would otherwise face heavy taxation in a taxable account. In 2025, three categories stand out:

- U.S. and Global Equities with Structural Tailwinds

Companies leading in AI infrastructure, cybersecurity, healthcare innovation, and industrial automation offer durable growth potential. Broad exposure through low-cost ETFs (e.g., VTI, IXN) provides diversification, while selective individual stocks can amplify returns. - Small-Cap and Emerging Market Equities

These higher-volatility segments often outperform over full market cycles. Their tax-inefficiency in taxable accounts (due to frequent rebalancing or turnover) makes them especially well-suited for Roth sheltering. - Private Market Access (Where Permitted)

While most Roth IRAs are held at brokerages limiting investments to public securities, self-directed Roth IRAs can hold private equity, real estate, or venture funds—unlocking institutional-grade opportunities. This route requires a specialized custodian but can significantly enhance long-term compounding.

What to Avoid

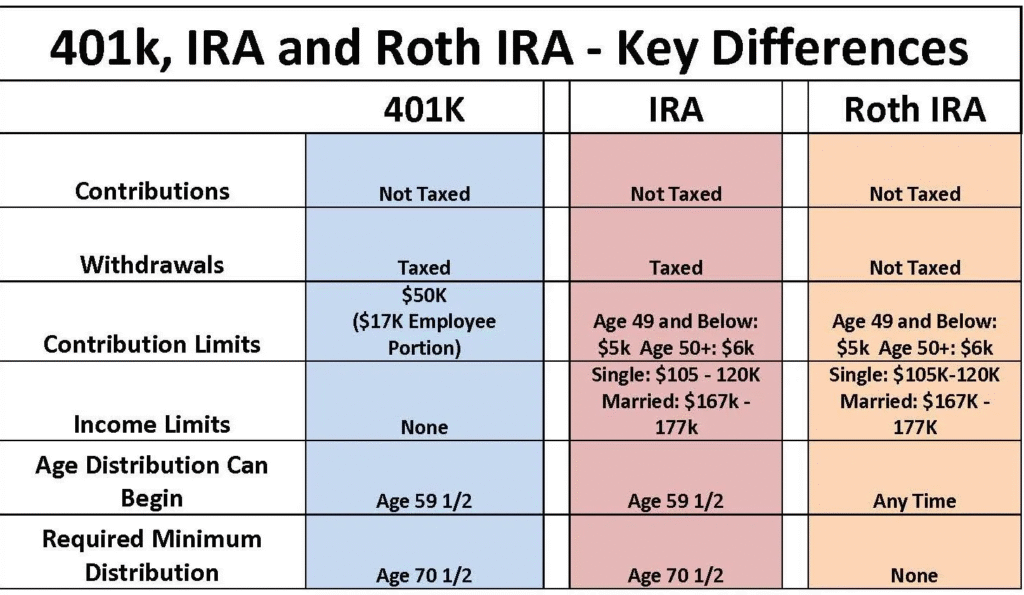

Low-yielding cash, bonds, or dividend-heavy funds are generally poor fits for Roth IRAs. These assets generate modest returns and are already tax-efficient in taxable accounts (e.g., municipal bonds) or better suited for tax-deferred accounts like traditional IRAs.

The Institutional Perspective: Think Like a Long-Term Allocator

At ValueFinity, we advise clients to treat their Roth IRA as a “growth vault”—reserved for assets with 10+ year horizons. For those eligible, pairing a core equity position with strategic exposure to innovation themes (e.g., clean tech, AI enablers, or global infrastructure) aligns with the Roth’s compounding advantage.

For accredited investors, self-directed options can mirror institutional strategies: for instance, a private equity stake in a climate-tech startup or a fractional interest in a logistics real estate portfolio—both held tax-free within a Roth structure.

Conclusion

The best investments for a Roth IRA in 2025 prioritize growth over income and longevity over liquidity. By aligning asset selection with the account’s tax-free superpower, investors can maximize compounding while minimizing future tax drag.

Learn more about strategic portfolio design at valuefinity.com or reach us at Capital@valuefinity.com .