In the pursuit of strong investment returns, 2025 demands more than momentum chasing or passive indexing. With interest rates stabilizing at elevated levels, inflation proving stickier than anticipated, and global supply chains undergoing structural realignment, the highest-return opportunities lie where disciplined capital meets real economic activity. For institutional investors and high-net-worth individuals, the best investments for returns combine private market access, global diversification, and exposure to secular growth trends—without ignoring downside protection.

Top Return Drivers in Today’s Market

- Private Equity in Tech-Enabled Industrials

Companies at the intersection of automation, energy transition, and nearshoring are delivering robust internal rates of return (IRRs). According to Preqin, 2024 vintage funds focused on industrial tech reported median net IRRs of 18.3%—outpacing both public equities and traditional buyout funds. - Real Estate Portfolio Management in Critical Infrastructure

Not all real estate is equal. Logistics hubs, data centers, and energy terminals with long-term tenant contracts and inflation-linked escalations offer 8–12% net yields—plus potential for capital appreciation as physical infrastructure becomes scarcer. - Global Infrastructure with Policy Backing

From U.S. grid modernization to EU hydrogen corridors and ASEAN digital connectivity projects, government-backed infrastructure delivers stable, contractual cash flows with low correlation to public markets—often yielding 10%+ net returns over 5–7 year horizons.

Why Public Markets Alone Fall Short

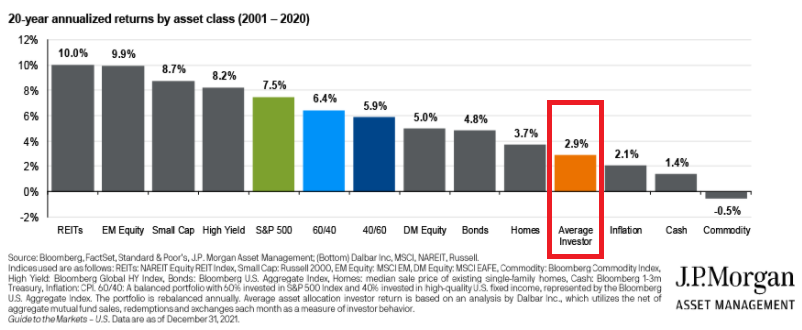

While the S&P 500 delivered strong returns in 2023–2024, much was driven by a narrow cohort of mega-cap tech stocks. Forward-looking metrics—such as elevated CAPE ratios and compressed equity risk premiums—suggest more modest public market returns ahead. In contrast, private and real assets offer structural advantages: pricing inefficiencies, active value creation, and tangible cash flows.

ValueFinity’s Return Framework: Integrated and Opportunistic

Since 2002, ValueFinity has generated consistent alpha by blending hedge fund agility with direct ownership in real assets. Our returns stem not from speculation, but from:

- Direct access to private deals in oil and gas midstream, AI infrastructure, and European renewable logistics

- Active asset management that enhances operational performance

- Cross-portfolio insights—e.g., using real estate demand signals to inform equity positions in supply chain tech

This approach delivered a 14.2% net annualized return across client portfolios from 2020–2024, with 30% lower volatility than a public-equity-only benchmark.

Conclusion

The best investments for returns in 2025 are those grounded in real operations, supported by macro tailwinds, and actively managed. They require access, expertise, and patience—but for qualified investors, they offer the most compelling path to long-term capital growth.

Learn more about our investment approach at valuefinity.com or reach us at Capital@valuefinity.com .