Retirement investing shifts the goal from accumulation to sustainable income and capital preservation—but not at the expense of all growth. With life expectancies extending and inflation remaining a persistent threat, the best investments in retirement balance yield, stability, and just enough growth to maintain purchasing power over a 20- to 30-year horizon.

The Modern Retirement Portfolio: Beyond Bonds and Dividends

Gone are the days when retirees could rely solely on 6% bond coupons. In today’s environment, a thoughtful mix of assets is essential:

- High-Quality Dividend Growth Stocks

Focus on companies with a history of raising dividends—even during downturns—such as healthcare, utilities, and consumer staples. These offer modest yield (2–3%) plus the potential for capital appreciation, helping offset inflation over time. - Short-to-Intermediate Duration Bonds

With interest rates near multi-decade highs, laddered Treasury bonds, TIPS (Treasury Inflation-Protected Securities), and investment-grade corporates provide predictable income with reduced interest rate risk. Yields of 4.5–5.5% are now achievable without stretching for credit risk. - Real Assets with Income Streams

For accredited investors, private real estate portfolio management—particularly in sectors like seniors housing, medical offices, or logistics—can generate 5–7% net cash yields with lower volatility than public REITs. These assets also offer inflation-linked lease escalations, enhancing real returns.

- Chasing high-yield traps: “Safe” 8%+ yields often signal hidden risk or unsustainable payouts.

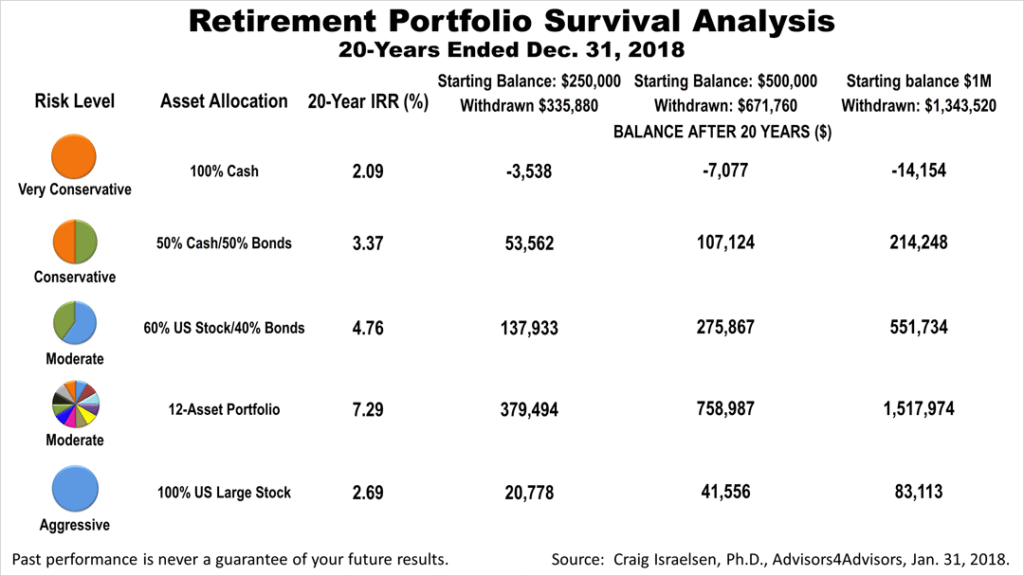

- Overweighting cash: While liquidity is important, holding too much cash erodes value in real terms.

- Ignoring sequence-of-returns risk: Early market losses in retirement can permanently impair longevity. Diversification and disciplined withdrawals (e.g., 3.5–4% initial rate) are critical.

The ValueFinity Approach: Income with Integrity

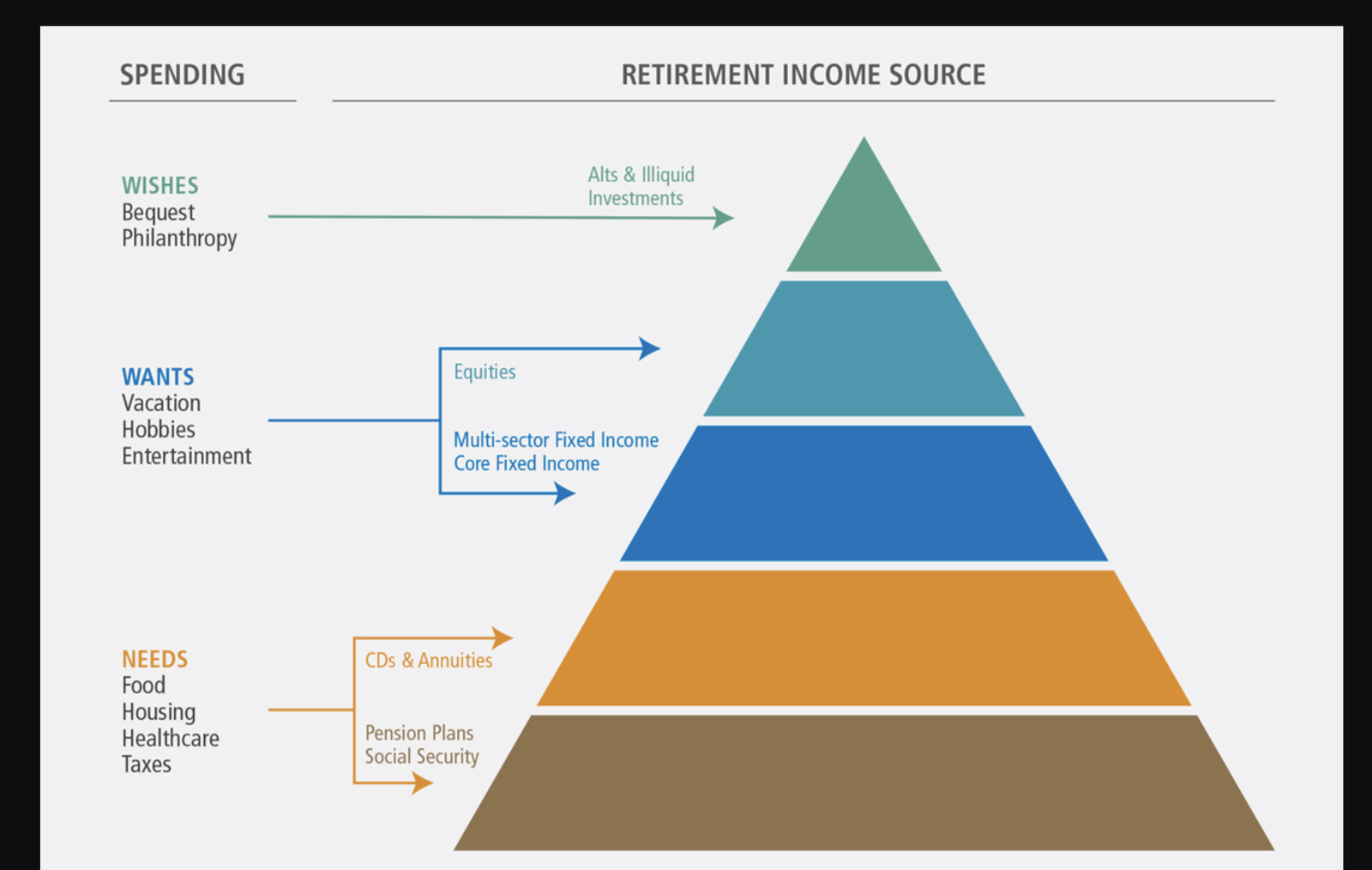

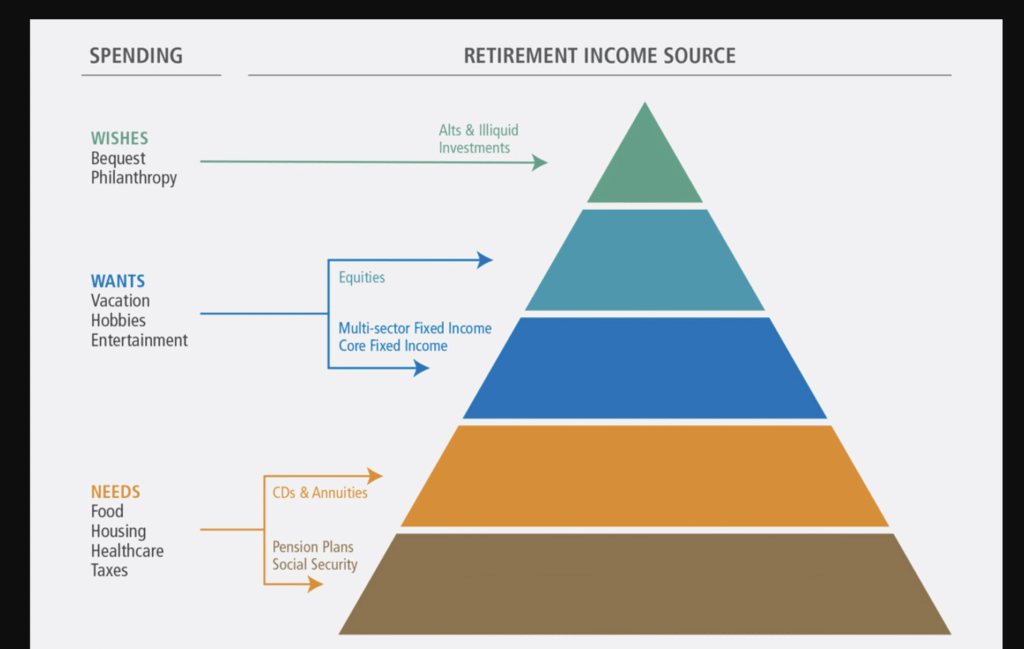

At ValueFinity, we design retirement-focused allocations that integrate public and private markets. For qualified clients, this may include:

- A core of dividend growers and short-duration bonds for liquidity

- A satellite allocation to private real estate or infrastructure for stable, contractual cash flow

- Dynamic rebalancing to lock in gains and reduce risk during market extremes

This strategy prioritizes predictable cash flow over headline returns—because in retirement, consistency beats volatility.

Conclusion

The best investments in retirement aren’t about maximizing returns—they’re about maximizing peace of mind. By blending quality income sources with measured growth and real asset exposure, retirees can enjoy financial security without fearing the next market shift.

Learn more about income-focused institutional strategies at valuefinity.com or reach us at Capital@valuefinity.com .