In 2025, the term “best investments platform” often evokes sleek apps, AI-driven recommendations, and one-click portfolio building. While user experience matters, sophisticated investors—particularly institutions, family offices, and high-net-worth individuals—prioritize deeper criteria: direct access to high-quality assets, transparent oversight, fiduciary alignment, and integration across public and private markets. For these investors, the best platform isn’t a consumer app—it’s a trusted institutional partner.

The Limitations of Retail-Focused Platforms

Popular platforms like Robinhood, SoFi, or even traditional brokerages excel at democratizing market access but fall short in critical areas:

- Limited or no access to private equity, real estate portfolio management, or infrastructure

- Algorithmic advice that ignores macro context or tax efficiency

- Revenue models based on payment for order flow or premium subscriptions—not client performance

According to a 2025 CFA Institute survey, 78% of institutional allocators said retail platforms “lack the depth required for strategic capital deployment.”

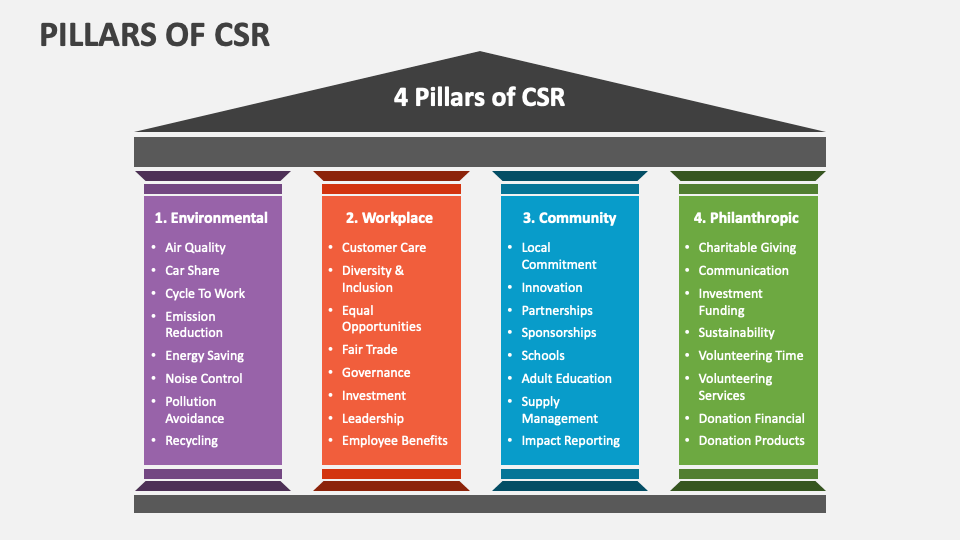

What Defines a True Institutional Investment Platform

The best platforms for serious capital offer:

- Direct deal access to private markets (not just fund-of-funds wrappers)

- Customized reporting with asset-level transparency

- Integrated strategy across hedge fund, private equity, real estate, and public markets

- Fiduciary duty—with fees aligned to performance and co-investment by the manager

These capabilities enable investors to move beyond passive indexing and into value-creating, real-return strategies.

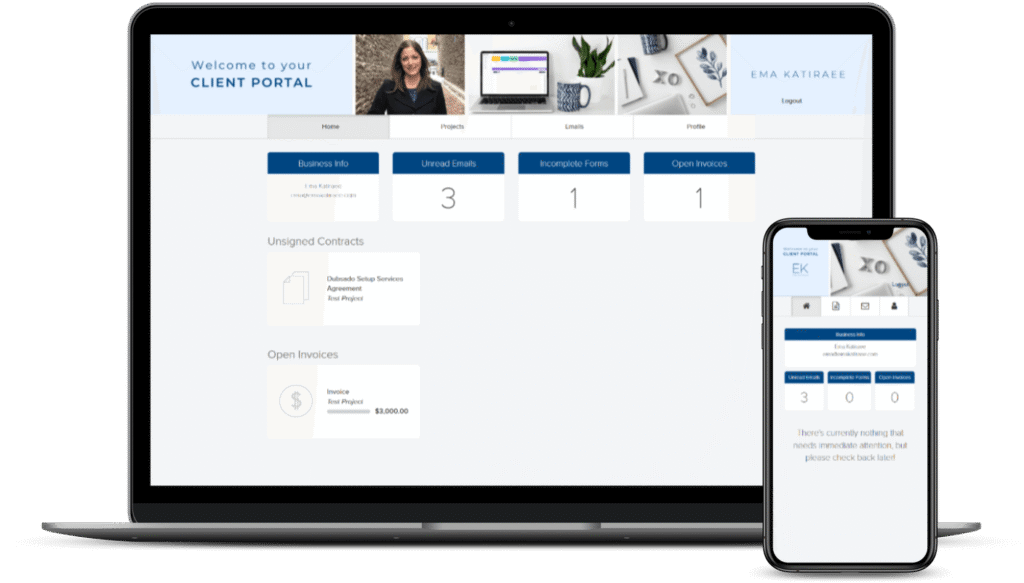

The ValueFinity Model: Platform as Partnership

ValueFinity does not operate a public-facing trading app. Instead, we provide qualified clients with a secure, bespoke investment portal that reflects their unique holdings across:

- Global equities and hedge fund strategies

- Direct real estate assets (e.g., logistics, data centers)

- Private equity stakes in tech, energy, and infrastructure

But the real platform is our team: decades of on-the-ground asset management, cyclical experience since 2002, and a commitment to deploying capital where it generates sustainable, risk-aware returns.

For example, while retail platforms highlight meme stocks or ETF themes, our clients received early access to a private placement in a North American hydrogen logistics terminal—now generating 7.2% net annual cash flow with government-backed offtake agreements.

Conclusion

The best investments platform in 2025 isn’t judged by its user interface, but by the quality of its opportunities, the rigor of its oversight, and the integrity of its alignment with client goals. For investors seeking more than market beta, partnership beats platform every time.

Learn more about our institutional investment platform at valuefinity.com or reach us at Capital@valuefinity.com .