For new investors, apps can lower barriers to entry, simplify account setup, and provide educational resources. In 2025, platforms like Fidelity, Charles Schwab, and Vanguard offer beginner-friendly interfaces with $0 commissions, fractional shares, and built-in research tools. Meanwhile, apps such as SoFi Invest and M1 Finance add automated portfolio building and goal-based tracking—helping newcomers develop saving habits and market familiarity.

However, it’s critical to understand: the best investments apps for beginners are onboarding tools, not long-term strategies. They excel at accessibility but often lack depth in asset selection, tax efficiency, or exposure to real-return assets like private equity or income-producing real estate.

What Beginners Should Look For

- Low or No Fees

Avoid platforms charging account maintenance fees or high expense ratios on recommended funds. Fidelity and Schwab offer core index funds with expense ratios below 0.02%. - Fractional Shares and Automatic Investing

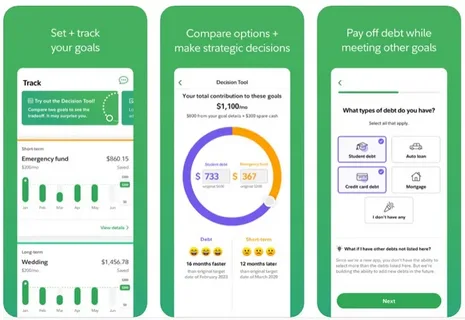

The ability to buy partial shares of expensive stocks (e.g., Amazon, Google) and set recurring deposits encourages consistent participation—key for long-term compounding. - Educational Content and Guardrails

Apps like Acorns and Wealthfront include basic financial literacy modules and risk-questionnaire-driven portfolios, reducing impulsive trading.

- Gamified interfaces (e.g., confetti animations, social feeds) that encourage frequent trading—harmful to long-term returns.

- Overreliance on robo-advice that ignores tax location, estate planning, or personal liquidity needs.

- Misleading “high-yield” cash accounts that aren’t FDIC-insured or carry hidden rate resets.

When to Move Beyond the App

Once you’ve built an emergency fund, maximized employer 401(k) matches, and started a Roth IRA, consider whether your goals require more than a retail app can offer. Do you seek:

- Exposure to private markets?

- Tax-coordinated portfolio design?

- Customized income strategies in retirement?

If so, it’s time to engage a fiduciary advisor or institutional partner—not just upgrade your app.

Conclusion

The best investments apps for beginners are those that foster discipline, not speculation. Use them to start—but plan to evolve. Sustainable wealth isn’t built through convenience alone, but through strategy, diversification, and time.

For guidance on transitioning to institutional-grade investing, visit valuefinity.com or contact us at Capital@valuefinity.com .