In 2025, real estate remains one of the most compelling asset classes for long-term investors—but not all property types are created equal. With higher-for-longer interest rates, evolving work patterns, and rapid technological adoption, the best real estate investments are those aligned with structural economic shifts, backed by contractual cash flows, and located in supply-constrained markets. For institutional investors and accredited individuals, success lies in moving beyond residential speculation and into purpose-built, income-generating assets.

Top Real Estate Investment Themes for 2025

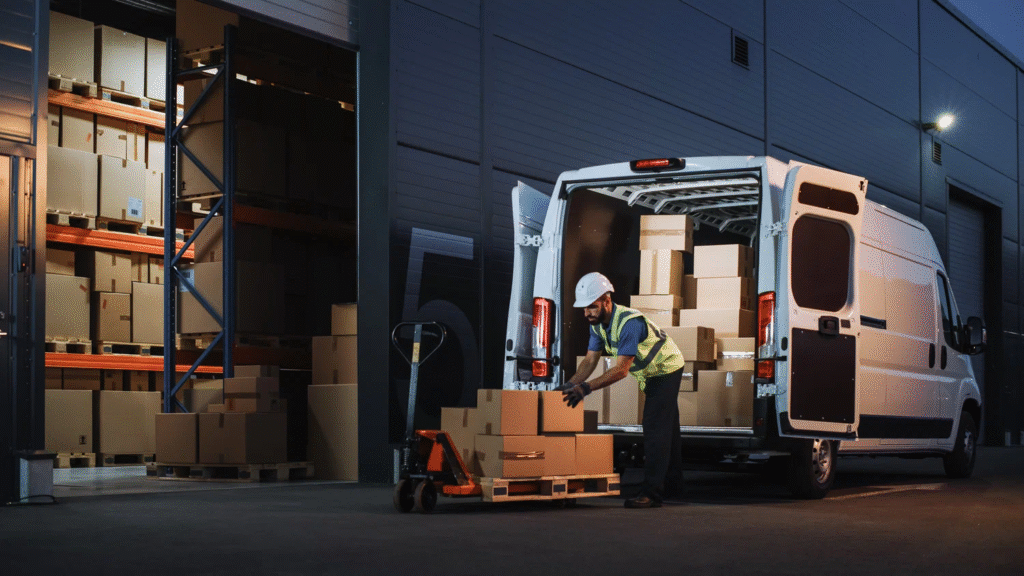

- Logistics & Industrial Warehousing

E-commerce penetration continues to grow globally, driving demand for last-mile distribution centers and bulk logistics parks. Vacancy rates in major U.S. Sun Belt markets remain below 4%, and new supply is limited by land scarcity and permitting delays. These assets often feature 10-year, triple-net leases with annual rent escalations—delivering 5–7% net yields with strong tenant covenants. - Data Centers Supporting AI Infrastructure

The AI boom has triggered an unprecedented surge in power and cooling demand. Data centers in power-rich, tax-advantaged locations (e.g., Northern Virginia, Arizona, and the Nordic region) are leasing at record pace. Investors with direct access to “powered shell” developments or built-to-suit projects are capturing 8%+ risk-adjusted returns—often with hyperscaler tenants like Microsoft, Amazon, or Google. - Medical Office Buildings (MOBs) and Seniors Housing

Backed by demographic tailwinds—aging populations and rising healthcare utilization—MOBs and high-quality seniors housing offer recession-resilient income. Unlike retail or office, these uses benefit from inelastic demand and long-term provider contracts. Well-located MOBs are yielding 5.5–6.5% with occupancy rates above 92%.

Avoid: Overhyped or Obsolete Segments

- Class B/C office buildings: Remote work has permanently reduced demand; many face refinancing risk.

- Speculative residential development: Oversupply in sunbelt markets and high mortgage rates pressure pricing.

- Retail malls without experiential or necessity-based tenants: Only grocery-anchored or lifestyle centers show resilience.

The ValueFinity Edge: Direct Ownership, Not Passive Exposure

At ValueFinity, we don’t rely on public REITs or crowdfunding platforms. Since 2002, we’ve managed over $6 billion in direct real estate assets. Our approach includes:

- Acquiring land and developing or repositioning assets in high-barrier markets

- Securing long-term leases with creditworthy tenants before capital deployment

- Integrating real estate into broader hedge fund and private equity strategies (e.g., pairing data center ownership with AI equity exposure)

This operational control enables better risk management, higher yields, and true inflation protection.

Conclusion

The best investments in real estate in 2025 aren’t about location alone—they’re about function, tenant quality, and alignment with irreversible economic trends. For investors seeking durable income and capital appreciation, purpose-built real assets offer a rare combination of scarcity, cash flow, and macro resilience.

Learn more about our institutional real estate portfolio management at valuefinity.com or reach us at Capital@valuefinity.com .