Mutual funds remain a cornerstone of diversified investing—especially for retirement accounts and long-term savers. In 2025, the best mutual funds are not the most actively hyped, but those that deliver broad market exposure, low fees, and tax efficiency while avoiding hidden costs and manager turnover. For investors seeking simplicity without sacrificing performance, the focus should be on structure, not star ratings.

The Case for Low-Cost, Passively Managed Funds

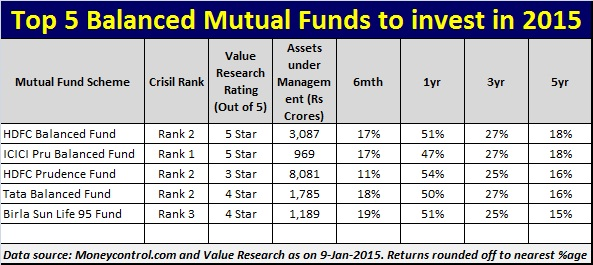

Decades of data confirm that the majority of actively managed mutual funds underperform their benchmarks after fees. According to Morningstar’s 2025 U.S. Fund Landscape Report, only 23% of active U.S. equity funds beat their index over the past 10 years. In contrast, low-cost index mutual funds consistently deliver market-matching returns with minimal drag.

The best mutual funds for most investors include:

- Total U.S. Stock Market Funds

Examples: Vanguard Total Stock Market Index Fund (VTSMX), Fidelity ZERO Total Market Index Fund (FZROX)

Expense Ratio: As low as 0.00%–0.04%

Why: Instant diversification across large-, mid-, and small-cap U.S. companies. - International Stock Index Funds

Examples: Vanguard Total International Stock Index Fund (VTIAX)

Expense Ratio: ~0.07%

Why: Adds geographic diversification and exposure to faster-growing emerging markets. - U.S. Aggregate Bond Funds

Examples: Vanguard Total Bond Market Index Fund (VBTLX)

Expense Ratio: ~0.05%

Why: Provides core fixed-income exposure with broad credit and duration diversification.

Red Flags in Mutual Fund Selection

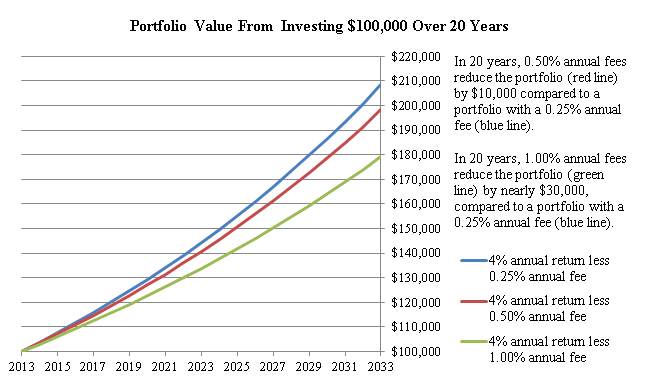

- High expense ratios (>0.50%): Fees compound silently—1% in annual fees can erase 25%+ of returns over 30 years.

- Front-end or back-end loads: These sales charges benefit brokers, not investors. Stick to no-load funds.

- Chasing past performance: Funds that led in 2023 often lag in 2024 due to style rotation or asset bloat.

When Active Management Might Make Sense (Rarely)

In less efficient markets—such as emerging market debt or small-cap value—skilled active managers can add value. However, investors should demand:

- A consistent investment process (not just a hot hand)

- Low turnover (<30% annually) to minimize tax drag

- Co-investment by the portfolio manager (skin in the game)

Even then, the odds remain challenging. Most investors are better served by pairing low-cost index funds with strategic allocations to private markets outside their mutual fund accounts.

Conclusion

The best investments in mutual funds are simple, transparent, and cheap. They form a reliable foundation—but should not be the entirety of a sophisticated investor’s strategy. For those seeking alpha beyond beta, private equity, real estate portfolio management, and global infrastructure offer complementary, higher-return opportunities.

Learn more about integrated institutional strategies at valuefinity.com or reach us at Capital@valuefinity.com .