In 2025, dividend investing has evolved beyond chasing the highest payout ratios. With market volatility, shifting interest rates, and economic uncertainty, the best dividend investments prioritize sustainability, growth, and financial discipline—not just headline yield. For income-focused investors, the goal is to build a portfolio of companies that consistently pay—and raise—dividends through economic cycles, offering both reliable cash flow and long-term capital appreciation.

Three Pillars of High-Quality Dividend Investing

- Dividend Aristocrats and Kings

These are companies in the S&P 500 that have raised dividends for 25+ years (Aristocrats) or 50+ years (Kings). Examples include Johnson & Johnson (healthcare), 3M (industrials), and Coca-Cola (consumer staples). They operate in defensive sectors with inelastic demand, strong cash flows, and conservative balance sheets—enabling them to grow payouts even during recessions. - High-Quality REITs with Real Asset Backing

Not all REITs are equal. Focus on those with:- Essential-use properties (e.g., data centers, cell towers, medical offices)

- Long-term leases with creditworthy tenants

- Low payout ratios (<75% of FFO)

Companies like American Tower (AMT) and Realty Income (O) offer 4–5% yields with inflation-linked escalations and decades of dividend growth.

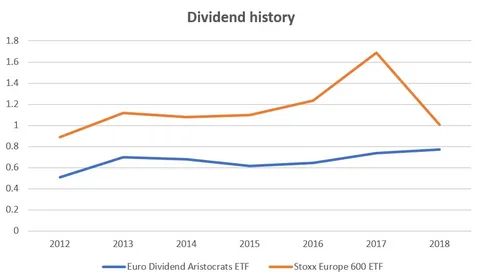

- International Dividend Leaders

Markets like Canada (energy infrastructure), Australia (mining), and Europe (utilities) offer compelling dividend opportunities often overlooked by U.S.-centric investors. ETFs like SPDR S&P International Dividend ETF (DWX) provide diversified access to global high-yield, high-quality names—with yields often exceeding 5%.

- Yield >8% with no payout growth: Often signals distress or unsustainable distributions (e.g., mortgage REITs, struggling telecoms)

- High payout ratios (>90% of earnings): Leaves little room for reinvestment or downturns

- No dividend growth in 5+ years: Inflation erodes stagnant income over time

Maximize After-Tax Income with Smart Account Placement

- Hold high-dividend stocks and REITs in tax-advantaged accounts (Traditional IRA or 401(k))—since dividends are taxed as ordinary income

- Use Roth accounts for dividend growers to enjoy tax-free compounding of rising payouts

- Avoid holding high-yield equities in taxable accounts unless they qualify for qualified dividend treatment (typically 15–20% tax rate vs. 37% ordinary income)

Conclusion

The best investments for dividends in 2025 are those that combine reliability, growth, and resilience. By focusing on companies with pricing power, strong balance sheets, and a culture of shareholder returns, investors can build an income stream that outlasts market cycles—and outpaces inflation.

For institutional-grade income strategies that integrate private real assets with public dividend equities, visit valuefinity.com or reach us at Capital@valuefinity.com .