As we look toward 2026, investors face a world reshaped by persistent inflation, AI-driven productivity gains, geopolitical realignment, and the accelerating transition to clean energy. The best investments for 2026 will not be those chasing yesterday’s winners—but those anchored in real assets, global diversification, and durable cash flows that thrive regardless of short-term market sentiment.

Three High-Conviction Investment Themes for 2026

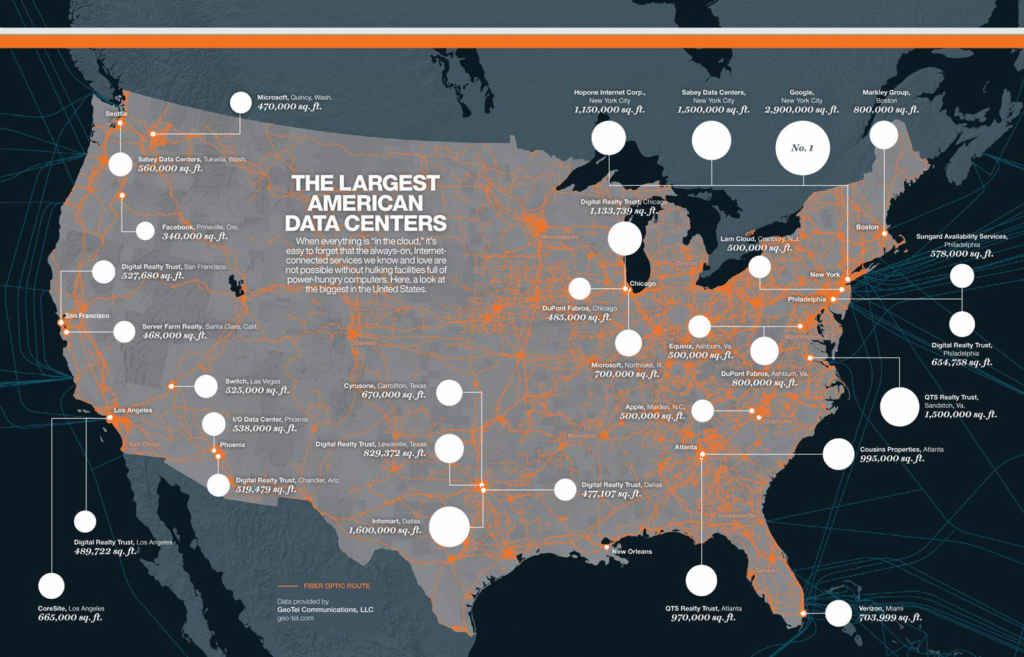

- AI Infrastructure & Digital Real Estate

The AI boom is shifting from hype to hardware. Demand for data centers, fiber networks, and power infrastructure is surging—especially in energy-rich, tax-advantaged regions like the U.S. Sun Belt, Nordic countries, and Texas. These assets generate 7–9% net yields through long-term leases with hyperscalers (Amazon, Microsoft, Google). Unlike speculative AI stocks, they offer tangible, contracted income backed by real-world scarcity. - Global Energy Transition Infrastructure

Government policies (U.S. Inflation Reduction Act, EU Green Deal, Asia-Pacific hydrogen initiatives) are unlocking $1.7 trillion in clean energy investment through 2030. In 2026, the highest-quality opportunities include:- Midstream hydrogen and CO₂ transport pipelines

- Grid modernization and battery storage facilities

- Renewable-powered industrial parks

These projects often feature 10–15 year offtake agreements with utilities or governments—delivering 8–12% net IRRs with low commodity risk.

- Private Real Estate in Defensive Sectors

Not all real estate is equal. In 2026, focus on assets with inelastic demand and inflation-linked leases:- Medical office buildings (backed by aging demographics)

- Last-mile logistics hubs (driven by e-commerce and nearshoring)

- Seniors housing with care services (occupancy rates >90% in quality operators)

These generate 5–7% net annual cash flow with recession-resilient tenant bases.

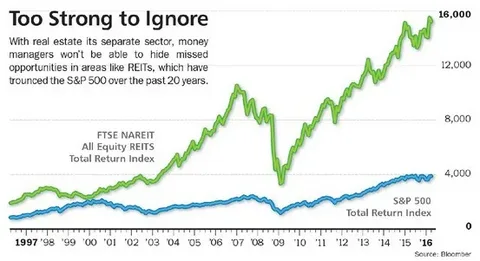

Why Public Markets Alone Won’t Suffice

While the S&P 500 may continue to benefit from AI leadership, valuation risks are elevated. Forward P/E ratios remain above 20x, and earnings growth is increasingly concentrated in a narrow cohort of mega-caps. Meanwhile, private and real assets offer:

- Pricing inefficiencies (less competition)

- Active value creation (operational improvements)

- Lower correlation to public sentiment

According to Preqin, diversified private capital strategies outperformed public equities by 4.1% annually over the past five years.

The ValueFinity 2026 Strategy: Integrated and Forward-Looking

At ValueFinity, we’re allocating capital today to assets that will define tomorrow:

- Direct ownership in AI-supporting data center corridors

- Co-investment in North American hydrogen logistics terminals

- Strategic equity exposure to industrial automation enablers

Our approach blends hedge fund agility with real asset discipline—ensuring we capture both innovation and income.

Conclusion

The best investments for 2026 are not speculative—they’re structural. They reflect irreversible trends: digitalization, decarbonization, and demographic aging. By anchoring your portfolio in real economic activity, you position for growth without gambling on macro noise.

Learn more about our forward-looking, institutional-grade strategies at valuefinity.com or reach us at Capital@valuefinity.com .