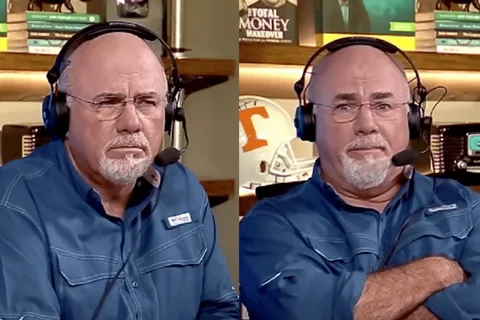

Dave Ramsey, a well-known personal finance personality, advocates for a highly conservative, debt-averse investment strategy centered on behavioral discipline, simplicity, and capital preservation. His approach resonates with millions seeking financial stability—especially those recovering from debt or building foundational wealth. However, for accredited investors, institutions, and high-net-worth individuals, the “best investments” in 2025 often extend beyond Ramsey’s framework to include real assets, global diversification, and institutional-grade opportunities that enhance long-term compounding.

Below, we compare Ramsey’s recommendations with broader institutional best practices—without judgment, but with clarity on who each approach serves.

Dave Ramsey’s Core Investment Philosophy

Ramsey’s investing advice, as outlined in his Baby Steps and Financial Peace programs, emphasizes:

- 100% Equity Allocation in Mutual Funds

- Invest only in four types of mutual funds: Growth, Growth & Income, Aggressive Growth, and International.

- Avoid bonds, real estate (outside primary residence), and individual stocks.

- Use target-date funds or his “4-fund blend” via employers or IRAs.

- No Debt, Ever

- Pay off all debt (including mortgages) before aggressive investing.

- Avoid leverage under any circumstances.

- Simplicity Over Optimization

- No tax-loss harvesting, asset location, or alternative investments.

- Focus on behavior: “Just invest 15% of your income and stay consistent.”

Where Ramsey’s Approach Works—and Where It Falls Short

Strengths:

- Ideal for beginners recovering from debt or lacking financial literacy

- Eliminates emotional decisions through rigid rules

- Avoids catastrophic risks like leverage or speculation

Limitations for Advanced Investors:

- No inflation hedge: 100% equities + no real assets = vulnerability to stagflation

- Ignores tax efficiency: Holding bonds in taxable accounts or missing Roth/IRA optimization

- Overlooks income needs: Retirees may need yield—not just growth

- Misses private market alpha: Real estate, private equity, and infrastructure have outperformed public markets over the past decade (Preqin, 2025)

Institutional “Best Investments” in 2025: A Broader View

For those with capital, accreditation, and a long-term horizon, the best investments include:

- Private real estate portfolio management (logistics, data centers, seniors housing)

- Global infrastructure with policy-backed cash flows (energy transition, grid modernization)

- Private equity in industrial tech and AI enablers

- Strategic bond allocations for volatility dampening and rebalancing fuel

These assets offer lower correlation to public markets, contractual income, and inflation resilience—critical in today’s macro environment.

Bridging the Gap: When to Evolve Beyond Ramsey

Ramsey’s advice is a launchpad—not a ceiling. Once you’ve:

- Built an emergency fund

- Eliminated high-interest debt

- Maximized tax-advantaged accounts

…it’s prudent to consider more sophisticated strategies that preserve purchasing power and generate income, not just growth.

For example:

- A Ramsey follower might hold a target-date fund.

- An institutional investor might hold that same fund as a core, then layer in private real estate for yield and TIPS for inflation protection.

Conclusion

Dave Ramsey’s best investments are behavioral tools designed to stop financial self-sabotage. For many, they’re life-changing. But for those with capital, time, and accreditation, the true “best investments” in 2025 integrate simplicity with sophistication—using public markets for beta and real assets for alpha.

For investors ready to expand beyond mutual funds into global, institutional-grade opportunities, visit valuefinity.com or reach us at Capital@valuefinity.com .