Deflation—sustained falling prices across goods and services—is rare in modern economies but poses a unique threat to investors. Unlike inflation, which erodes cash value, deflation increases the real burden of debt, suppresses consumer spending, and can trigger a vicious cycle of falling demand, layoffs, and asset devaluation. The best investments during deflation prioritize high-quality fixed income, strong balance sheets, and assets that retain value when money becomes more valuable.

Top Investments for a Deflationary Environment

1. Long-Duration, High-Quality Government Bonds

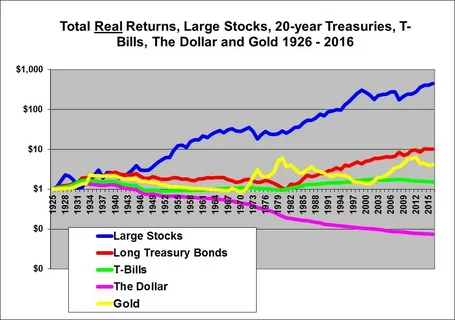

In deflation, central banks typically slash interest rates toward zero, driving bond prices higher—especially for long-duration U.S. Treasuries. With falling prices, the fixed coupons on these bonds gain real purchasing power over time. During Japan’s deflationary decades (1990s–2010s), JGBs (Japanese Government Bonds) delivered positive real returns while equities stagnated.

ETF Option: iShares 20+ Year Treasury Bond ETF (TLT) or Vanguard Long-Term Treasury ETF (VGLT)

2. Cash and Cash Equivalents

In a deflationary spiral, holding cash becomes a strategic advantage. As prices fall, each dollar buys more. High-yield savings accounts, money market funds, and short-term T-bills (even at low nominal yields) gain real value when consumer prices decline. Unlike in inflationary periods, cash is not trash—it’s a weapon.

Instrument: U.S. Treasury Bills (T-Bills) or FDIC-insured money market accounts

3. Defensive, Low-Debt Equities with Recession-Resilient Demand

While most stocks suffer in deflation (due to falling revenues and profit margins), a few sectors hold up:

- Consumer staples (e.g., Procter & Gamble, Walmart) – people still buy soap and food

- Healthcare (e.g., UnitedHealth, Johnson & Johnson) – medical needs don’t disappear

- Utilities with regulated returns – stable cash flows, often government-backed

Crucially, these companies must carry minimal debt, as deflation makes debt repayment more expensive in real terms.

ETF Option: Consumer Staples Select Sector SPDR (XLP) or Schwab U.S. Dividend Equity ETF (SCHD)

What to Avoid During Deflation

- Real estate and commodities: Their nominal prices fall as demand collapses (e.g., housing in 2008, oil in 2015–16).

- High-yield (junk) bonds: Default risk spikes as corporate revenues shrink.

- Leveraged assets or businesses: Debt becomes harder to service as income declines.

- Gold: Often underperforms in deflation (unlike in inflation), as investors prefer income-generating safe assets like bonds.

The Institutional Perspective: Deflation Is Rare—But Preparation Matters

True deflation is uncommon in the U.S. (last seen in the Great Depression), but disinflation (falling inflation toward zero) can mimic its effects. At ValueFinity, we monitor:

- Yield curve dynamics (inversion + flattening)

- Consumer demand trends (declining retail sales, rising savings rates)

- Debt service ratios (household and corporate)

If deflation risks rise, we tactically increase allocations to long-duration Treasuries and cash while reducing exposure to cyclical equities and real assets.

Conclusion

The best investments during deflation are not about growth—they’re about preserving capital in a world where prices fall and debt weighs heavier. By anchoring your portfolio in high-quality bonds, cash, and essential-sector equities, you protect purchasing power while avoiding irreversible losses.

For institutional-grade strategies designed to navigate all macro regimes—including deflation—visit valuefinity.com or reach us at Capital@valuefinity.com