The Great Depression (1929–1939) remains the deepest and longest economic contraction in modern U.S. history. With GDP falling 30%, unemployment peaking near 25%, and the Dow Jones losing nearly 90% of its value, few assets provided shelter—let alone returns. Yet history reveals that some investments not only survived the Depression but laid the foundation for generational wealth. While past performance doesn’t guarantee future results, the lessons remain relevant for investors preparing for severe systemic stress.

What Actually Worked During the Great Depression

1. U.S. Treasury Bonds (Especially Long-Duration)

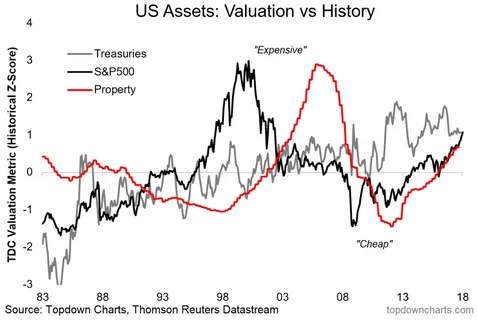

While stocks collapsed, long-term U.S. government bonds delivered strong positive returns. From 1929 to 1933, the S&P 500 fell 70%, but 10-year Treasuries returned +38% (nominal) as interest rates plummeted and investors sought safety. After 1933, FDR’s policies (including abandoning the gold standard) stabilized the financial system, reinforcing Treasuries as the ultimate safe haven.

Modern Equivalent: iShares 20+ Year Treasury Bond ETF (TLT) or direct T-bonds

2. High-Quality, Dividend-Paying Stocks with Low Debt

A small cohort of companies—those with essential products, conservative balance sheets, and pricing discipline—not only survived but continued paying dividends:

- Procter & Gamble – raised dividends every year through the 1930s

- Johnson & Johnson – maintained operations and payouts

- Consolidated Edison (utility) – benefited from regulated, inelastic demand

These firms avoided leverage and cut costs without sacrificing core value—proving that quality matters more than sector.

3. Productive Real Assets: Farmland and Essential Infrastructure

While urban real estate collapsed, productive farmland held value—especially in regions with reliable rainfall and transport access. Farmers who owned land outright (debt-free) could ride out price swings and benefit from New Deal agricultural support programs. Similarly, toll roads, pipelines, and railroads with essential traffic generated cash flow when managed prudently.

What Failed Catastrophically

- Margin-driven equities: Over 80% of 1929 stock purchases used margin—wiping out leveraged investors.

- Corporate and municipal bonds: Default rates exceeded 25% by 1933; many issues became worthless.

- Gold (after 1933): FDR’s Executive Order 6102 confiscated private gold holdings and devalued the dollar—punishing hoarders.

- Cash under the mattress: While cash gained purchasing power during deflation, holding it outside banks was risky (bank runs, theft).

Strategic Lessons for Today’s Investors

- Avoid leverage at all costs – Debt magnifies losses in deflationary downturns.

- Prioritize income over speculation – Dividends and bond coupons provided lifelines.

- Own real, productive assets – Land, infrastructure, and essential services outlast financial engineering.

- Trust institutions—but verify – Even “safe” banks failed; diversification and oversight mattered.

At ValueFinity, we embed these lessons into our framework:

- No leverage in core portfolios

- Focus on assets with contractual cash flows (e.g., data centers, energy terminals)

- Hold short- and long-duration Treasuries as ballast

- Stress-test for 1930s-style scenarios in risk modeling

Conclusion

The best investments during the Great Depression weren’t about getting rich—they were about not going broke. They combined prudence, patience, and an unshakable focus on real economic value. In today’s complex world, those principles remain the bedrock of enduring wealth.

While we don’t anticipate a repeat of the 1930s, preparing for tail risks ensures resilience in any environment.

For institutional-grade strategies built on historical rigor and real asset discipline, visit valuefinity.com or reach us at Capital@valuefinity.com .