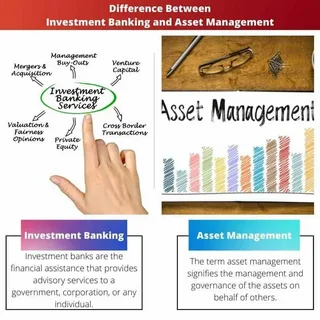

When investors ask for the “best investment banks,” they’re often conflating two distinct roles:

- Bulge-bracket institutions that underwrite deals, advise on M&A, and serve corporations (e.g., Goldman Sachs, JPMorgan)

- Wealth and asset management arms of banks that serve individual and institutional investors

For high-net-worth individuals, family offices, and institutions, the real question isn’t which bank is “best” in name—but which provides high-quality investment access, fiduciary-aligned advice, and transparent fee structures. In 2025, the landscape reveals a clear divide: large banks offer scale, but specialized firms often deliver superior risk-adjusted returns.

Where Major Banks Excel—and Fall Short

Strengths:

- JPMorgan Private Bank, Goldman Sachs Private Wealth Management, and Morgan Stanley Wealth Management offer integrated services: banking, lending, estate planning, and access to IPOs or private equity funds.

- Their research teams provide macro insights and sector analysis used by institutional investors globally.

- They serve as gatekeepers to exclusive offerings—though often with high minimums ($10M+ in some cases).

Limitations:

- Many bank-offered products carry embedded fees or favor proprietary funds, creating potential conflicts of interest.

- Access to truly differentiated assets (e.g., direct real estate, infrastructure) is often limited to ultra-high-net-worth tiers.

- Their strategies can be benchmark-hugging, lacking the agility of specialized asset managers.

The Rise of the Specialized Alternative

Firms like ValueFinity—though not banks—offer what many bank clients seek:

- Direct ownership in real assets (oil and gas midstream, data centers, logistics real estate)

- Private equity co-investment opportunities with transparent terms

- Multi-asset hedge fund strategies unbound by internal product mandates

Unlike banks constrained by balance sheet priorities, independent firms align capital with long-term investor outcomes—not cross-selling quotas.

What Sophisticated Investors Prioritize in 2025

- Direct access: Not just funds-of-funds, but underlying asset-level transparency

- Co-investment alignment: Managers who invest their own capital alongside clients

- Real-return focus: Exposure to income-generating assets that outpace inflation

- Fiduciary duty: Fee-only or performance-aligned compensation models

These criteria often lead investors beyond Wall Street banks to specialized partners with operational expertise in real estate portfolio management, energy, and global infrastructure.

Conclusion

The best “investment banks” for serious investors aren’t necessarily banks at all. They’re firms that combine institutional rigor with direct asset control, transparency, and a track record of long-term capital growth—without the conflicts of a full-service financial conglomerate.

Learn more about our institutional investment approach at valuefinity.com or reach us at Capital@valuefinity.com .