A bear market—defined as a 20%+ decline in major equity indices—is not just a statistical event; it’s a test of investor psychology and portfolio resilience. While painful in the short term, bear markets also create rare opportunities for long-term investors. The best investments during a bear market prioritize capital preservation, income stability, and selective opportunism—not panic selling or speculative rebounds.

Top Investments for Bear Market Resilience

1. Short-to-Intermediate Duration U.S. Treasuries

During equity selloffs, investors flee to safety—driving demand for U.S. government debt. With yields near 4.5–5.0% in 2025, 1–5 year Treasury notes offer attractive real returns with near-zero credit risk. Historically, bonds and stocks have exhibited strong negative correlation during bear markets (e.g., 2008, 2020), making Treasuries a powerful portfolio stabilizer.

ETF Option: iShares 3–7 Year Treasury Bond ETF (IEI) or Vanguard Short-Term Treasury ETF (VGSH)

2. Defensive Dividend Stocks with Pricing Power

Companies in healthcare, utilities, and consumer staples tend to outperform during downturns. Their products are essential, and their cash flows remain stable even when consumers cut discretionary spending. Focus on Dividend Aristocrats—firms with 25+ years of consecutive payout increases—that also maintain low debt and strong balance sheets.

ETF Option: Schwab U.S. Dividend Equity ETF (SCHD) or Procter & Gamble (PG), Johnson & Johnson (JNJ)

3. Cash as Strategic Dry Powder

Holding 10–20% of your portfolio in cash or cash equivalents (e.g., money market funds, T-bills) allows you to:

- Rebalance into equities at discounted prices

- Avoid forced selling at market lows

- Exploit dislocations in private markets (for accredited investors)

In the 2020 bear market, investors who deployed cash in March–April captured over 60% gains in the S&P 500 within 12 months.

Opportunistic Moves: Buying Quality on Sale

Bear markets indiscriminately punish even high-quality companies. This creates entry points for:

- Blue-chip equities with strong balance sheets and global reach

- Private real estate or infrastructure debt trading at discounts (for accredited investors)

- Distressed credit opportunities with senior collateral

At ValueFinity, we historically increase allocations to real assets like data centers and energy infrastructure during bear market troughs—when seller distress creates pricing dislocations.

What to Avoid

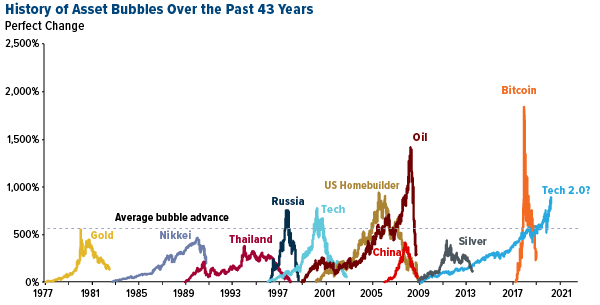

- Cyclical and speculative stocks: Tech, crypto, and consumer-discretionary names often fall hardest and recover slowest.

- Leveraged ETFs: Designed for daily trading; decay erodes value over time.

- Market timing: Trying to “catch the bottom” usually leads to missed opportunities. Instead, dollar-cost average or scale in gradually.

The Institutional Mindset: Bear Markets Are Not Catastrophes—They’re Resets

Since 1929, the S&P 500 has endured 14 bear markets. Every single one was followed by a full recovery—and new highs. The average bear market lasts 10 months; the average bull market lasts 4.5 years. Time in the market beats timing the market.

At ValueFinity, we treat bear markets as portfolio stress tests—and buying windows for durable assets. Our focus remains on real cash flows, global diversification, and long-term compounding, not short-term noise.

Suggested Image 4: A long-term S&P 500 chart with bear markets shaded in red—each followed by a steeper upward trajectory—caption: “Bear Markets Are Painful. But Never Permanent.”

Conclusion

The best investments during a bear market are those that protect capital while positioning you to participate in the inevitable recovery. Stay disciplined, avoid emotional decisions, and remember: the greatest risk isn’t volatility—it’s selling low and missing the rebound.

For institutional-grade strategies designed to navigate market cycles with resilience and opportunity, visit valuefinity.com or reach us at Capital@valuefinity.com .