The Individual Retirement Account (IRA)—whether Traditional or Roth—is one of the most powerful vehicles for long-term wealth building. But its true potential is unlocked only when paired with the right investments. In 2025, with evolving tax laws, elevated market valuations, and persistent inflation, the best IRA investments are those that align with the account’s tax structure while prioritizing growth, diversification, and strategic asset location.

Match the Investment to the IRA Type

Roth IRA: Prioritize High-Growth, Tax-Inefficient Assets

Since Roth contributions are made with after-tax dollars and all future growth is tax-free, this account is ideal for investments with the highest long-term return potential—especially those that would otherwise generate heavy tax liabilities in a taxable account. Top choices include:

- U.S. and global equities, particularly small-cap and emerging market stocks

- Growth-oriented ETFs focused on AI, automation, or clean energy infrastructure

- Private equity or venture capital (via a self-directed Roth IRA), for accredited investors seeking institutional returns

Traditional IRA: Focus on Income-Generating or Tax-Deferred Assets

Because withdrawals are taxed as ordinary income, Traditional IRAs are better suited for assets that:

- Generate ordinary income (e.g., bonds, REITs, high-dividend stocks)

- Have lower expected growth but provide stability

- Benefit from tax deferral on compounding interest or distributions

Top IRA Investment Strategies for 2025

- Low-Cost, Diversified Index Funds

Core holdings like Vanguard Total Stock Market (VTSMX) or Fidelity ZERO International Index (FZILX) offer instant diversification with expense ratios near zero—maximizing net returns over decades. - Small-Cap and Emerging Market Exposure

These higher-volatility segments historically outperform over full market cycles. Their tax inefficiency (due to frequent turnover) makes them perfect for IRA sheltering. - Self-Directed IRA Opportunities (for Accredited Investors)

Through a self-directed IRA custodian, investors can hold:- Private real estate portfolio assets (e.g., logistics, data centers)

- Private equity stakes in energy or tech

- Infrastructure notes with contractual yields

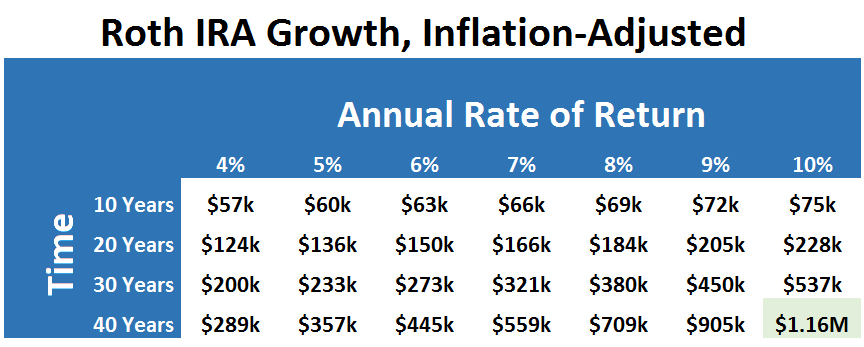

These assets often deliver 8–12% net returns with low correlation to public markets—and grow entirely tax-deferred (Traditional) or tax-free (Roth).

What to Avoid in an IRA

- Municipal bonds: Already tax-exempt—waste of IRA’s tax-advantaged status.

- Life insurance or collectibles: Prohibited by IRS rules.

- High-fee active funds: Expense ratios above 0.50% erode compounding; stick to low-cost index or rigorously vetted active strategies.

Conclusion

The best investments for an IRA in 2025 go beyond ticker symbols—they reflect a deliberate strategy to leverage tax advantages for maximum compounding. Whether using a standard brokerage IRA or a self-directed structure, the goal is the same: position your highest-return assets where they can grow most efficiently.

For accredited investors seeking institutional-grade IRA opportunities in real estate, private equity, and global infrastructure, learn more at valuefinity.com or reach us at Capital@valuefinity.com .