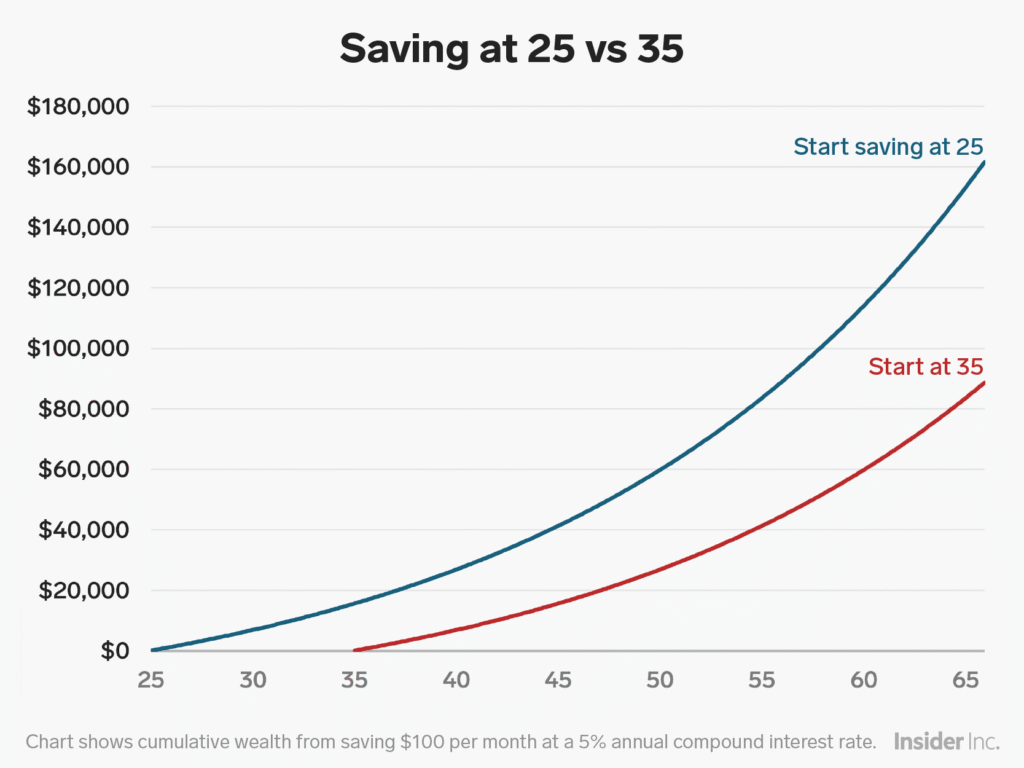

For young adults in 2025—whether just starting a career, paying down student debt, or earning their first full-time salary—the best investments aren’t about picking hot stocks or timing crypto rallies. They’re about leveraging time, minimizing costs, and automating smart habits. With decades of compounding ahead, even modest, consistent contributions can grow into life-changing wealth. The key is to start early, stay consistent, and avoid common behavioral pitfalls.

Three Foundational Investments for Young Adults

- Roth IRA with Low-Cost Index Funds

If you have earned income, a Roth IRA is your most powerful tool. Contributions are made with after-tax dollars, but all growth and withdrawals after age 59½ are 100% tax-free. Invest in a diversified mix like:- 80% U.S. total stock market (e.g., VTI or FZROX)

- 20% international stocks (e.g., VXUS)

With expense ratios near 0.00%, these funds offer instant global diversification. Just $300/month from age 25 could grow to over $1 million by 65 (assuming a 9% annual return).

- Employer-Sponsored 401(k) – At Least Enough to Get the Match

If your employer offers a 401(k) match (e.g., “50% match up to 6% of salary”), contribute at least enough to capture that free money. It’s an instant 50–100% return on your investment—unbeatable in any market. - High-Yield Savings for Short-Term Goals

Before aggressive investing, build an emergency fund of 3–6 months’ expenses in a FDIC-insured high-yield savings account (currently yielding ~4.5–5.0%). This prevents debt accumulation during unexpected setbacks and keeps long-term investments intact.

Smart Habits That Compound Beyond Money

- Automate contributions: Set up recurring transfers to your Roth IRA or 401(k)—out of sight, out of mind.

- Avoid lifestyle inflation: Invest raises and bonuses instead of upgrading spending.

- Skip speculative bets: Meme stocks, crypto, and forex trading rarely build lasting wealth—and often derail discipline.

When You’re Ready to Level Up

Once you’ve built your foundation, consider:

- A taxable brokerage account for intermediate goals (e.g., a home down payment in 5–10 years)

- Learning about real assets like private real estate or infrastructure (accessible later via self-directed IRAs or institutional platforms)

But never let complexity delay the basics. Time is your greatest asset—and it’s non-renewable.

Conclusion

The best investments for young adults in 2025 are boring, automatic, and long-term. They don’t require stock-picking skill—just commitment to fundamentals. By starting early and staying the course, you’ll harness compounding in a way no late starter can replicate.

For guidance on building an institutional-grade foundation—even with modest income—visit valuefinity.com or reach us at Capital@valuefinity.com .