Europe presents a compelling—but nuanced—investment landscape in 2025. While growth remains modest compared to the U.S. or Asia, the region offers institutional-grade stability, deep real asset markets, and policy-driven opportunities in energy transition, digital infrastructure, and demographic resilience. For global investors, the best investments in Europe balance defensive income, regulatory tailwinds, and selective exposure to innovation.

Top Investment Opportunities in Europe (2025)

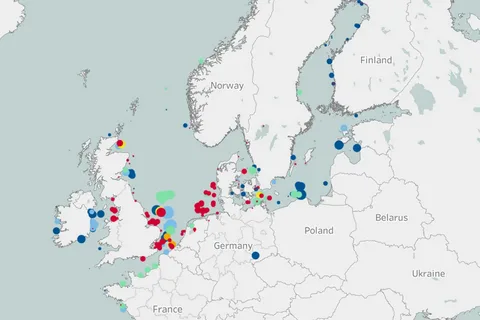

- European Energy Transition Infrastructure

The EU’s Green Deal and REPowerEU plan are funneling €1 trillion+ into decarbonization through 2030. High-conviction opportunities include:- Offshore wind and solar farms with 15-year government-backed power purchase agreements (PPAs)

- Hydrogen production and transport hubs in Germany, the Netherlands, and Spain

- Grid modernization and battery storage in France and the Nordics

These assets offer 7–10% net annual returns with low merchant risk—ideal for long-term, inflation-resilient income.

- Data Centers and Digital Infrastructure

AI adoption and cloud migration are driving record demand for data centers in Ireland, the Netherlands, and Sweden—regions with abundant renewable power, cool climates, and political stability. Institutional investors are acquiring or developing “powered shell” facilities leased to hyperscalers (e.g., AWS, Microsoft), yielding 8–9% net IRRs with 10+ year contracts. - Prime Logistics and Industrial Real Estate

Nearshoring, e-commerce growth, and supply chain resilience are fueling demand for Class A warehouses in key European corridors:- Benelux and Rhine-Ruhr (Germany)

- Paris and Madrid logistics hubs

- Central and Eastern Europe (Poland, Czechia) for manufacturing-linked distribution

Private real estate funds targeting these zones deliver 5–7% net cash yields with CPI-linked rent escalations.

Public Market Access for Global Investors

For those without direct private market access, consider:

- iShares MSCI Europe ETF (IEV) – Broad developed Europe exposure

- SPDR MSCI Europe Small Cap ETF (IEUS) – Access to agile, undervalued firms

- VanEck European Infrastructure ETF (INFR) – Focused on utilities, renewables, and transport

These provide liquidity and diversification, though with higher volatility than direct real assets.

Why Europe Stands Out for Institutional Capital

- Strong property rights and contract enforcement

- Deep institutional real estate and infrastructure markets (e.g., German Spezialfonds, Dutch pension mandates)

- Regulatory clarity on ESG and climate-aligned investing

- Currency diversification (euro, Swiss franc, Scandinavian krona)

At ValueFinity, we allocate to European assets not for growth alone, but for portfolio ballast—combining U.S. innovation with European stability.

Conclusion

The best investments in Europe in 2025 are not about betting on GDP surprises—they’re about owning real assets with contractual cash flows, backed by policy, geography, and demographic demand. For global investors, Europe offers a vital counterweight to more volatile markets, with income, resilience, and long-term value.

For institutional-grade strategies in European real assets and global portfolio management, visit valuefinity.com or reach us at Capital@valuefinity.com .