The United States remains one of the most dynamic and resilient investment environments globally—home to deep capital markets, technological innovation, and world-leading real assets. In 2025, with strong GDP growth, a robust labor market, and leadership in AI and energy infrastructure, the best investments in the U.S. combine structural tailwinds, institutional-grade execution, and tax-efficient structures to deliver sustainable returns.

Top U.S.-Based Investment Opportunities in 2025

- AI and Tech Infrastructure Real Estate

The surge in artificial intelligence has triggered unprecedented demand for data centers, powered shell facilities, and fiber networks. The U.S. leads global AI compute capacity, with key hubs in Northern Virginia, Dallas, Phoenix, and Atlanta. Investors with access to private real estate portfolio opportunities in these corridors are capturing 7–9% net yields from long-term leases with hyperscalers like Amazon, Microsoft, and Google. - Energy Transition and Midstream Infrastructure

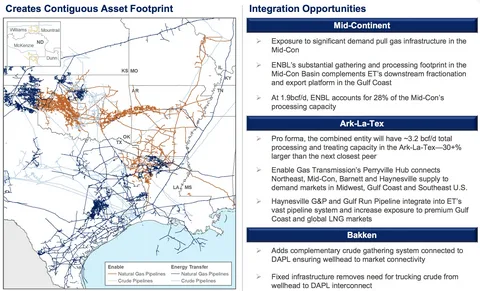

The U.S. is both an energy superpower and a leader in decarbonization investment. This duality creates compelling opportunities in:- Midstream oil and gas pipelines with fee-based, take-or-pay contracts (yielding 6–7%)

- Renewable hydrogen and carbon capture projects backed by IRA tax credits

These assets generate inflation-linked cash flows with low commodity exposure—ideal for stable, long-term income.

- Industrial and Logistics Real Estate

E-commerce, nearshoring, and supply chain resilience continue to drive demand for Class A warehouses in Sun Belt logistics hubs. Vacancy rates remain below 4%, and new development is constrained by land scarcity and permitting delays. Private real estate funds focused on this sector offer 5–7% net annual returns with contractual rent escalations.

Public Market Access for All Investors

For those without direct private market access, U.S.-listed ETFs and equities provide diversified exposure:

- Vanguard Total Stock Market ETF (VTI) – Core U.S. equity exposure, low cost

- Global X Data Center REIT ETF (VNQI) – Focused on digital infrastructure

- iShares U.S. Oil & Gas Infrastructure ETF (MLPX) – Exposure to midstream energy

These funds offer liquidity, transparency, and institutional-grade diversification.

Why the U.S. Still Leads in Institutional Capital Formation

- Deep, liquid public and private markets

- Strong property rights and regulatory clarity

- Innovation ecosystem supported by venture capital and federal R&D spending

- Favorable tax structures (e.g., Opportunity Zones, QOZ funds) for long-term investors

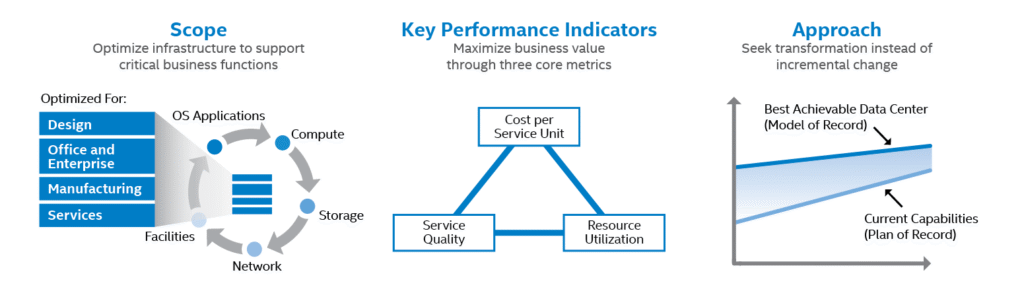

At ValueFinity, we leverage these advantages to build portfolios that compound value through operational control—not just passive ownership.

Conclusion

The best investments in the U.S. in 2025 are not speculative bets—they’re grounded in real economic activity, structural demand, and national competitive advantage. Whether through private real estate, infrastructure, or broad-market equities, American assets continue to offer some of the most reliable paths to long-term capital growth.

For institutional-grade strategies in U.S. real assets and global investments, visit valuefinity.com or reach us at Capital@valuefinity.com .