Deploying $10,000 in 2025 offers a powerful opportunity to build long-term wealth—especially when capital is allocated with discipline, low costs, and tax efficiency in mind. While this amount may not grant access to private equity or direct real estate, it’s more than enough to establish a diversified foundation that compounds over time. The best investments with $10K prioritize simplicity, automation, and strategic positioning—not speculation.

A Practical Allocation for Most Investors

- $7,000 – Core Growth via Low-Cost Index Funds

Invest in a Roth IRA or taxable brokerage using fractional shares:- $5,000 in a U.S. total stock market ETF (e.g., VTI or FZROX) for broad exposure

- $2,000 in an international developed markets ETF (e.g., VXUS) for global diversification

Both funds have expense ratios under 0.03% and automatically reinvest dividends—fueling compounding with zero effort.

- $2,000 – Inflation-Resilient Fixed Income

Allocate to short-duration U.S. Treasury ETFs like SHV or BIL, yielding ~5.2%. These provide stability, liquidity, and a buffer against equity volatility—ideal for rebalancing or near-term goals. - $1,000 – Strategic Satellite (Optional)

For those with a higher risk tolerance, use this portion to gain targeted exposure:- An AI or clean energy infrastructure ETF (e.g., IXY or TAN)

- Or contribute to a high-yield savings account as emergency dry powder

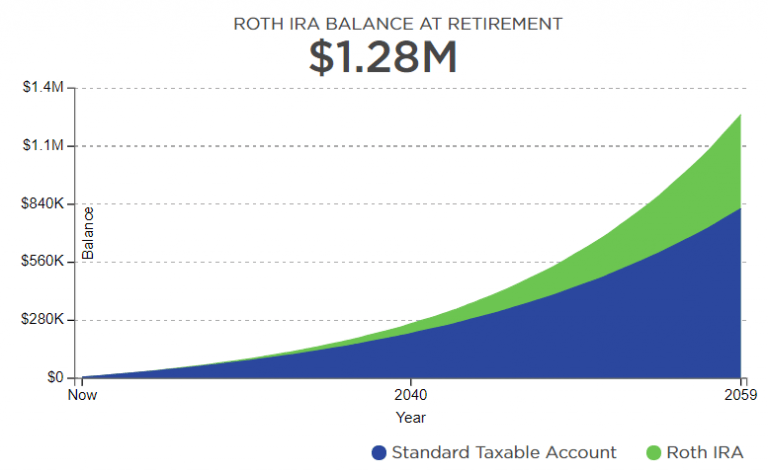

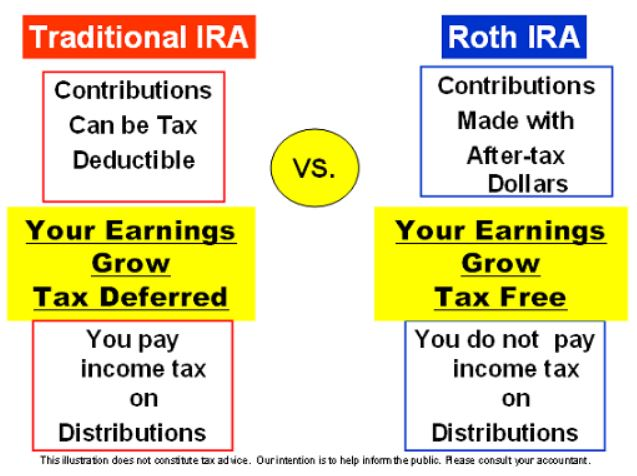

- If eligible, place the entire $10K in a Roth IRA—all future growth and withdrawals will be tax-free.

- If using a taxable account, stick to ETFs with low turnover to minimize capital gains distributions.

- Enable automatic dividend reinvestment (DRIP) to accelerate compounding without manual action.

- Individual stocks or crypto with your entire $10K: Overconcentration magnifies risk.

- High-fee robo-advisors or actively managed funds: A 1% fee can cost you $25,000+ in lost compounding over 30 years.

- Chasing “hot” trends without a plan: Strategy beats timing every time.

Conclusion

The best investments with $10K aren’t about getting rich quick—they’re about starting strong, staying consistent, and letting time and compounding do the heavy lifting. With the right structure, $10,000 today can grow into six or even seven figures over a lifetime.

For guidance on building a scalable, institutional-grade foundation—even with modest capital—visit valuefinity.com or reach us at Capital@valuefinity.com .