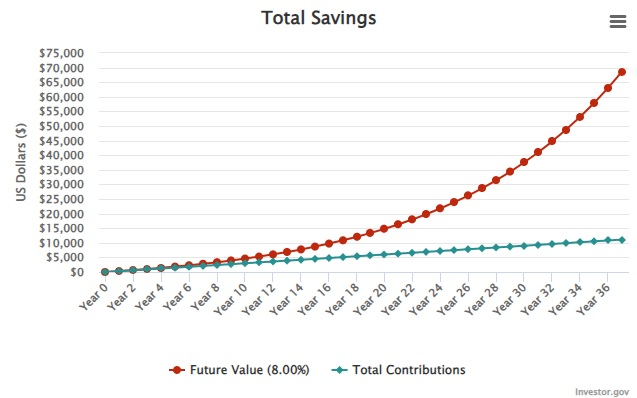

Compound interest—the exponential growth of capital through reinvested returns—is often called the eighth wonder of the world. But its power isn’t automatic. To maximize compounding, investors must pair time, reinvestment discipline, and tax-efficient structures with assets that deliver consistent, long-term returns. In 2025, the best investments with compound interest aren’t speculative—they’re foundational, diversified, and held in the right accounts.

Three High-Efficiency Compounding Vehicles

- Low-Cost Index Funds in a Roth IRA

A Roth IRA offers the ultimate compounding advantage: tax-free growth and withdrawals. Paired with a low-cost total market index fund (e.g., Vanguard Total Stock Market or Fidelity ZERO), $10,000 invested at age 30 could grow to over $1.3 million by age 65—assuming a 9% annual return and no taxes on gains. Reinvesting dividends automatically accelerates compounding without behavioral friction. - Dividend Growth Stocks with DRIPs (Dividend Reinvestment Plans)

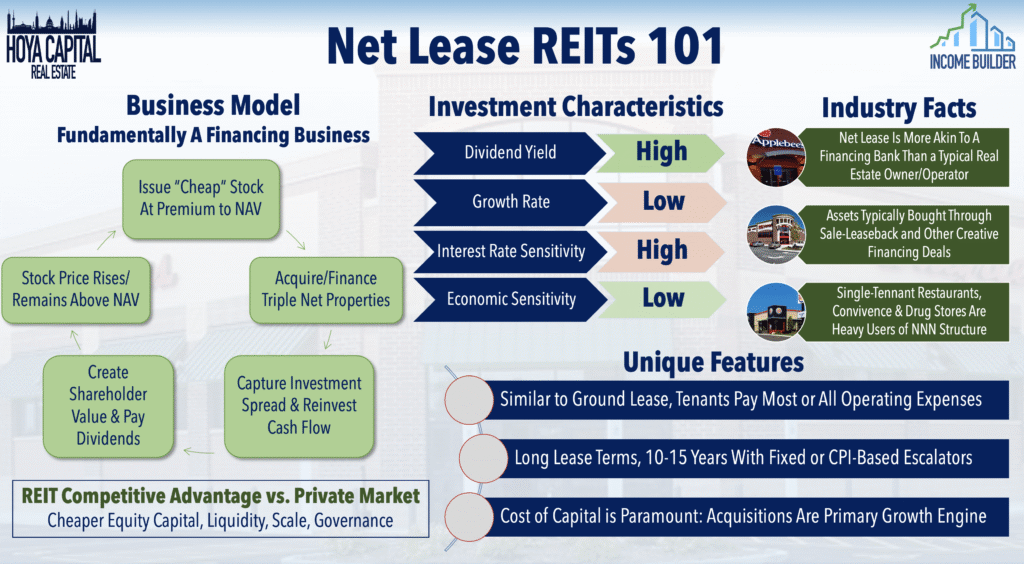

Companies that consistently raise dividends—like Johnson & Johnson or Microsoft—allow investors to buy additional shares automatically through DRIPs. Over decades, reinvested dividends account for over 40% of total equity returns (S&P Dow Jones, 2024). In a tax-advantaged account, this process compounds seamlessly. - Private Equity and Real Estate Portfolio Management (for Accredited Investors)

While less liquid, private assets often deliver superior long-term IRRs through compounding at the fund or asset level. For example, a private real estate fund distributing 6% annual cash flow can reinvest proceeds into new acquisitions—compounding equity through asset appreciation and rental growth. Held in a self-directed Roth IRA, these returns compound entirely tax-free.

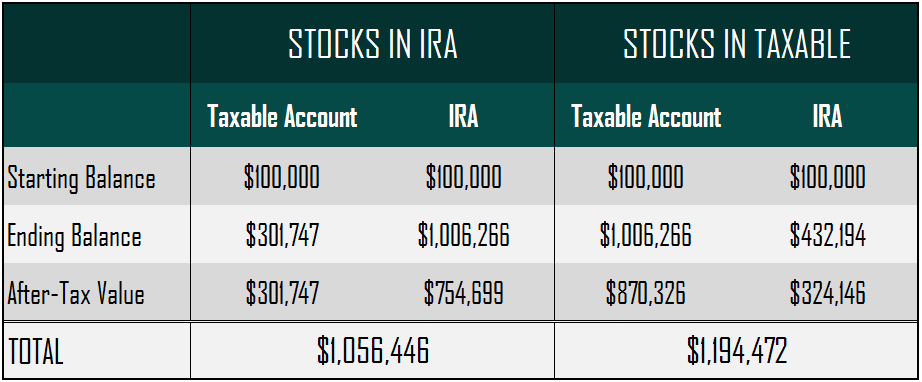

Why Account Structure Matters as Much as Asset Choice

Two identical investments can yield vastly different outcomes based on where they’re held:

- Taxable account: Capital gains and dividends are taxed annually, slowing compounding.

- Traditional IRA: Growth is tax-deferred, but withdrawals are taxed as ordinary income.

- Roth IRA: All growth compounds tax-free—ideal for high-return assets.

According to Vanguard (2025), strategic asset location can boost after-tax returns by 0.6–0.8% annually—a massive difference over decades.

Avoid These Compounding Killers

- High fees: A 1% annual fee reduces final wealth by ~25% over 30 years.

- Frequent trading: Disrupts reinvestment and triggers taxable events.

- Emotional withdrawals: Selling during downturns locks in losses and breaks the compounding cycle.

Conclusion

The best investments with compound interest combine quality assets, automatic reinvestment, and tax-efficient accounts. Whether through public equities or private real assets, compounding rewards patience, discipline, and structure—not timing or speculation.

For accredited investors seeking compounding opportunities in institutional-grade real estate and private equity—structured within tax-advantaged vehicles—learn more at valuefinity.com or reach us at Capital@valuefinity.com .