Vanguard has long been synonymous with low-cost, passive investing—particularly for retail investors and retirement accounts. Its index funds and ETFs, such as the Total Stock Market ETF (VTI) and Balanced Index Fund (VBIAX), offer broad market exposure at minimal fees. For many, Vanguard represents a foundational pillar of long-term wealth building. However, for institutional investors, family offices, and high-net-worth individuals seeking resilient, differentiated returns in 2025, a Vanguard-only approach may fall short in addressing inflation, volatility, and opportunity in private markets.

Where Vanguard Excels—and Where It Ends

Vanguard’s strength lies in efficiency, scale, and simplicity. Its funds provide reliable beta exposure with expense ratios often below 0.10%. In stable, low-rate environments, this strategy has delivered consistent results. Yet in today’s world—marked by structurally higher inflation, geopolitical fragmentation, and rapid technological change—pure passive exposure offers limited downside protection and no access to private market alpha.

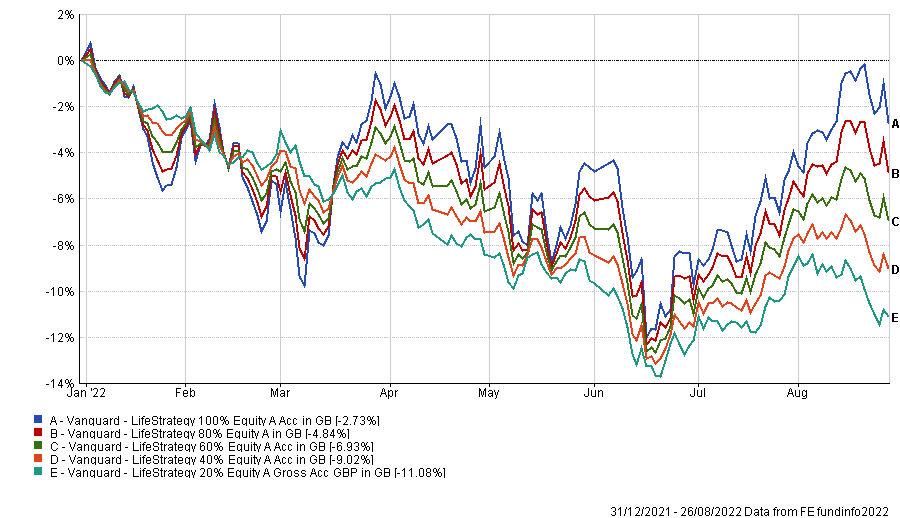

According to Morningstar (Q1 2025), traditional 60/40 portfolios anchored in Vanguard-style indexing experienced a 12% drawdown during the 2024 risk-off episode, while diversified alternatives—including private equity and real estate portfolio management—limited losses to under 4%.

The Institutional Alternative: Active, Integrated, Real-Asset Anchored

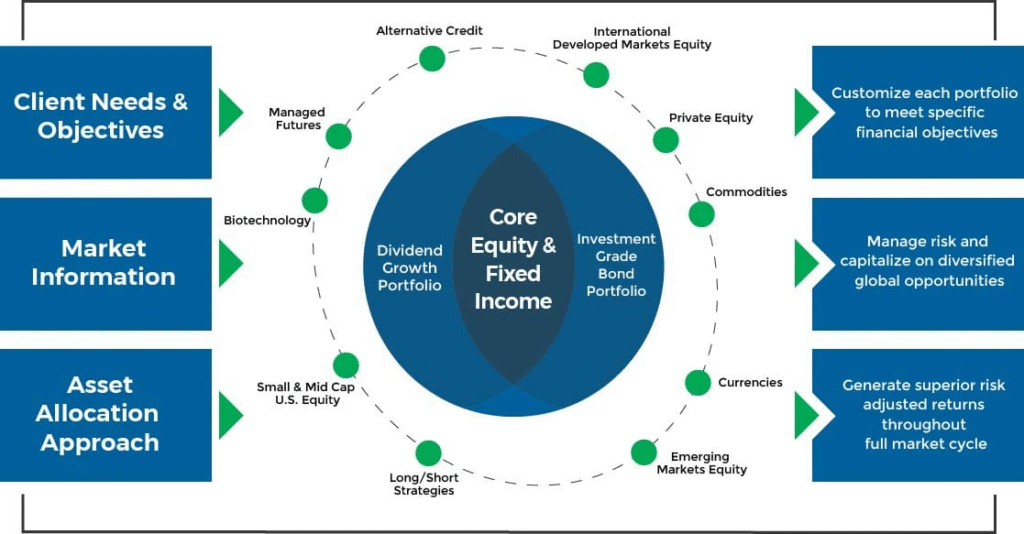

For sophisticated investors, the best investments in 2025 combine passive foundations with active, illiquid, and real-return strategies. This includes:

- Direct real estate in logistics, data centers, and energy infrastructure

- Private equity in tech-enabled industrials and decarbonization enablers

- Hedge fund strategies with cross-asset flexibility

Firms like ValueFinity—built on real asset expertise since 2002—offer this integration. Unlike Vanguard’s one-size-fits-all model, institutional partners tailor allocations to macro conditions, tax efficiency, and liquidity needs.

Why Complement, Don’t Replace

Vanguard remains a valuable tool for core public market exposure. But in 2025, leading allocators treat it as a base layer—not the entire strategy. The best investment approach layers Vanguard-like efficiency with actively managed, uncorrelated return streams that preserve capital when public markets correct.

For example, pairing VTI with direct stakes in AI-supporting infrastructure or inflation-resilient midstream energy assets creates a more robust risk-return profile than public equities alone.

Conclusion

Vanguard offers excellent passive building blocks—but the best investments for institutional investors in 2025 require more. They demand integration, real asset backing, and active oversight across public and private markets.

Learn more about our investment approach at valuefinity.com or reach us at Capital@valuefinity.com .